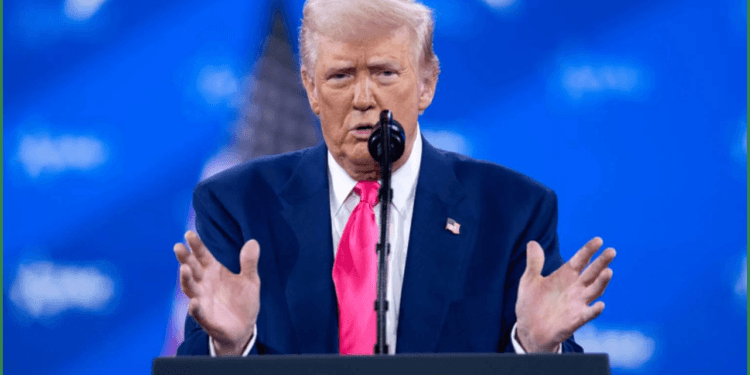

Washington, D.C. — President Donald Trump has introduced a new “Gold Card” visa, setting a $5 million investment threshold for wealthy foreigners seeking U.S. residency and a pathway to citizenship. The program replaces the existing EB-5 visa, which required an $800,000 investment in job-creating projects. The White House says the initiative will inject significant capital into the U.S. economy and help address the national debt, positioning the U.S. as a top contender in the global residency-by-investment market.

Golden visa programs—offering residency or citizenship in exchange for investment—have gained traction worldwide. Countries like Malta, Greece, and Portugal have long attracted high-net-worth individuals with competitive schemes. Malta’s program, for instance, requires a €738,000 investment, while Greece offers residency for a €250,000 real estate purchase. Portugal’s golden visa, starting at €280,000, grants citizenship eligibility after five years. Spain and Italy also offer residency for €500,000 and €250,000 investments, respectively, in sectors like property or government bonds.

Further afield, Turkey provides citizenship for a $400,000 property investment, and the UAE offers a 10-year renewable visa for AED 10 million ($2.7M) in assets. Canada’s Start-Up Visa Program targets entrepreneurs for permanent residency, while New Zealand’s Active Investor Plus Visa demands an NZD 15 million ($9M) investment, with citizenship possible after five years.

The U.S. “Gold Card,” priced at $5 million, now ranks among the world’s most expensive investor visas, surpassing many programs in cost but offering access to the American dream. Trump touted the program as a “game-changer,” arguing it ensures only the wealthiest contribute to economic growth. Details on job creation or specific investment sectors remain unclear, but the administration claims it will prioritize national interests.

Critics, however, argue that golden visas commodify citizenship and disproportionately favor the elite. Immigration advocates have raised concerns about equity, while some economists question whether the high price tag will deter investors when cheaper alternatives exist globally. Proponents counter that the program aligns with market trends, as nations increasingly compete for high-net-worth individuals to bolster their economies.

As the U.S. rolls out its “Gold Card,” the world watches to see if it can outshine established programs in Europe, Asia, and beyond—or if the steep cost will limit its appeal in an already crowded market.